COP28 has come and gone, with the UAE Consensus adopted and now potentially steering the world to a more rapid transition with its ambitious goals for deployment of low-carbon energy technologies. Three key goals of the UAE Consensus are:

Tripling renewable energy capacity globally and doubling the global average annual rate of energy efficiency improvements by 2030;

Accelerating zero- and low-emission technologies, including, inter alia, renewables, nuclear, abatement and removal technologies such as carbon capture and utilization and storage, particularly in hard-to-abate sectors, and low-carbon hydrogen production;

Accelerating the reduction of emissions from road transport on a range of pathways, including through development of infrastructure and rapid deployment of zero and low-emission vehicles;

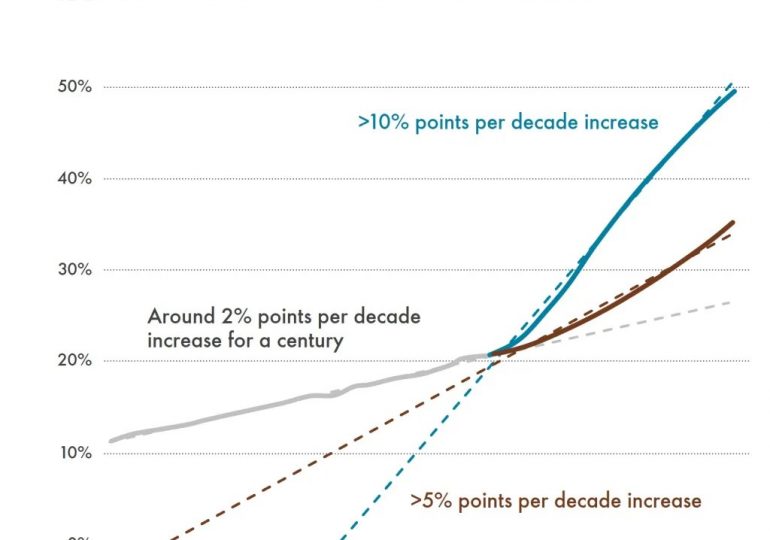

All of these goals drive the world towards rapid electrification of the energy system, through the direct production of electricity via solar PV and wind, the use of electricity in transport via electric vehicles and the use of electricity to make fuels such as hydrogen. In the Shell Energy Security Scenarios released earlier in the year, both scenarios, namely Sky 2050 and Archipelagos, showed a steep rise in the rate of electrification within the final energy system. Starting from the current annual gain in electricity in final energy of just 0.2% points per year, a rate that has been with us for the best part of a century, it leaps to 0.5% or even 1% point per year. The inflection point in the trend is in the near term, as shown in the chart below.

An electric world is also a world of much higher copper demand, driven by the role that copper plays as such an excellent conductor of electricity. Electric motors have copper winding, transmission lines use copper (although very long-distance transmission can also use aluminium), the infrastructure for building a solar PV farm relies on copper and recharging of electric vehicles requires connections made of copper.

In the Sky 2050 scenario, which sees deployment of renewable energy and electric vehicles on a scale equivalent to the goals set out in the UAE Consensus (see a recent posting by me on this), the scenario team have estimated the impact on global copper production. This is shown in the chart below, along with the trend required for Archipelagos.

Over the last forty years, the mining industry has been adding about 0.3 million tonnes per year, every year, to global copper production, but this isn’t fast enough for either of our scenarios to support their respective transitions. The current rate of production increase would barely support the EV transition in Sky 2050.

An electric car has 70 kgs more copper than a gasoline car, a 200 kW recharger needs 8 kg of copper and solar PV needs 5000 kg copper per MW. So in an accelerated EV 2040 case (Sky 2050) with 1.2 billion EVs on the road, 100 million charging points and 1200 GW of solar PV to supply the new electricity, global copper production would need to increase by 9 Mt p.a. in 17 years. But this takes up all the increase if the future production trend follows history, allowing nothing for the broader use of electricity or all the other applications that already demand copper.

The conclusion is that copper production needs to accelerate and reach a point where more than 1.5 million tonnes of production is added each year, or five times the current annual increase. So we come to a recent story in the Financial Times (FT) where the plight of a copper mine in Panama is discussed. I am not going to discuss the merits or otherwise of this particular mine, but the problems it is facing, and the similar problems faced by companies attempting to open new mines are not uncommon. Copper mining does have an environmental impact, like any extraction industry. Although the industry is well practiced in managing and minimizing the environmental impact, that impact will never be zero and like any industry there may be poorer performers who are singled out by environmentalists and local communities. Such singling out also contributes to the difficulty in establishing a new mine when local communities are concerned that the activity may have a similar impact on them.

Local mining issues also attract global activists, and in this case the FT notes that two prominent global environmental activists used their own networks and leverage to back the local protesters and seek the closure of the mine. Not surprisingly, both these people are strident climate activists as well, seeking a rapid energy transition, which requires abundant supplies of copper.

As noted above, it is not for me to discuss the merits or otherwise of this particular mine, but going forward our society is going to need every tonne of copper it can get its hands on. That shouldn’t mean miners get a free pass, but it does mean that constructive dialogue is essential in order to facilitate existing mining and open new mines. Outright rejection as both the global activists called for in this case isn’t going to help.

Note: Shell Scenarios are not predictions or expectations of what will happen, or what will probably happen. They are not expressions of Shell’s strategy, and they are not Shell’s business plan; they are one of the many inputs used by Shell to stretch thinking whilst making decisions. Read more in the Definitions and Cautionary note. Scenarios are informed by data, constructed using models and contain insights from leading experts in the relevant fields. Ultimately, for all readers, scenarios are intended as an aid to making better decisions. They stretch minds, broaden horizons and explore assumptions.

Leave a comment