Over 60 years ago I went on the first plane ride that I can recall, a relatively new Qantas Boeing 707 V-Jet from Malaya to Australia (we had travelled to the Federation of Malaya – as it was then – some three years earlier by ship), returning to Australia after my father’s military assignment. The Boeing 707 and it’s UK rival the de Havilland Comet were the first planes of the so-called jet-age, that transformed commercial aviation from a niche sector for a few to the global giant it is today.

The Boeing 707 first came into service in late 1958 and production finally ceased in 1991 (a military variant), with a few still in military and private use today. Commercial use spanned 55 years. Boeing introduced the 737 just 10 years after the 707 and multiple variants of it are still being produced today and still more being introduced (e.g. Boeing 737 MAX 10). While the current 737 shares the same basic fuselage shape and size as the original 737, significant differences exist in engine technology, wing design, cockpit avionics, and overall performance and efficiency capabilities. Looking at yet another Boeing series, between the first commercial flight of the 747 and its eventual complete retirement, the time span could be 80 years.

Flying today on a new Boeing 787 or Airbus A350 is a different experience to a Boeing 707 in the early 1960s, but the plane is basically the same, albeit with vast improvements. The 1960s 707s were turbofan jets using kerosene fuel from crude oil (Jet A then Jet A-1), and that remains the case today. An entire industry and significant global infrastructure now exist to supply a very tightly specified and highly quality-controlled fuel to a fleet of some 28,000 commercial aircraft.

Aviation rests on its superlative safety record, and while accidents do happen, the number of fatalities per million passengers has fallen from around 6 in the 1960s to less than 0.1 today (Source: Aviation Safety Network, 2024; Multiple sources compiled by World Bank, 2024 – processed by Our World in Data). One of the reasons behind this is a history of continuous improvement of a single technology set, that being turbofan jets running on kerosene fuel. This has involved refining and building experience around a single solution that works and then aiming for perfection. That learning curve has been running since the dawn of the jet-age and continues today, not only making planes safer, but also more efficient, quieter and more comfortable.

But aviation now faces a dilemma, that being its contribution to climate change. The contribution stems not only from the fossil fuel sourced carbon dioxide (CO2) in the engine exhaust, but also nitrous oxides, and particulates and water vapour that lead to contrail formation. To address these issues the aviation industry will have to depart from turbofan jets running on kerosene fuel and search for new sources of power.

The initial shift has been to use new fuels which have a much lower net carbon footprint but are otherwise chemically similar to existing fuels. The current sustainable aviation fuels (SAF) come from biogenic sources, but a future generation of such fuels could be produced via synthesis (e-SAF), using atmospheric CO2 and hydrogen electrolysed from water. While every fuel change in the aviation context is tested, trialled, and progressively certified for commercial use, such a change represents only a modest departure from the existing aviation technology set. Once tested and approved, these so-called drop-in fuels, can substitute for Jet A-1. This allows aviation to manage its environmental impact without a serious departure from the technology model that has been sustained and improved on over 70 years.

The alternative technology pathway which would involve changing the types of planes and their propulsion system sets up a much bigger challenge. Such a change may become necessary to fully manage both greenhouse gas emissions and contrail formation. Two possibilities for change are currently under consideration; battery electric planes and planes that are fuelled by liquid hydrogen. While both require a significant level of technology development for implementation, the introduction of such planes means starting a new learning cycle for safety and efficiency improvements, which is really where the challenge lies for this industry.

In the Shell 2025 Energy Security Scenarios, these technologies do make an appearance, but in different ways and on different timelines. For example, electric planes appear in all three scenario story-lines, but not until the 2030s given the limited options available now and the need to wait for further battery capacity improvements. Hydrogen fuelled planes appear in two scenarios, but only after 2040 in one story and still later in another. Both the battery electric and hydrogen technology pathways introduce many new safety considerations for the sector, including the basic engine design and the air-frame considerations for carrying liquid hydrogen. With everything changing, caution prevails such that the scaling of these technologies in the scenarios takes decades.

In all our scenarios, even by the end of the century, liquid hydrocarbon fuel remains the dominant aviation fuel, although the fuel could be coming exclusively from sustainable sources by then. The reason for the extended timeline is the long life of the planes themselves (25-35 years), the even longer timeline associated with a plane series and the conscious decision of the industry to carefully manage the introduction of anything new due to safety considerations.

In a recent report by Carbon Tracker, Awaiting take-off: Why aviation’s net zero plan still doesn’t fly, the authors argue that anticipating SAF and e-SAF as the main solutions for aviation simply locks in the capacity to burn fossil fuels. They state that the major aviation incumbents are exhibiting risk-averse path dependency, holding principally to their legacy businesses and making limited investments in new propulsion technology. They note that investment into conventional aircraft dwarfs current efforts to scale up new propulsion aircraft (electric, hydrogen and hybrid).

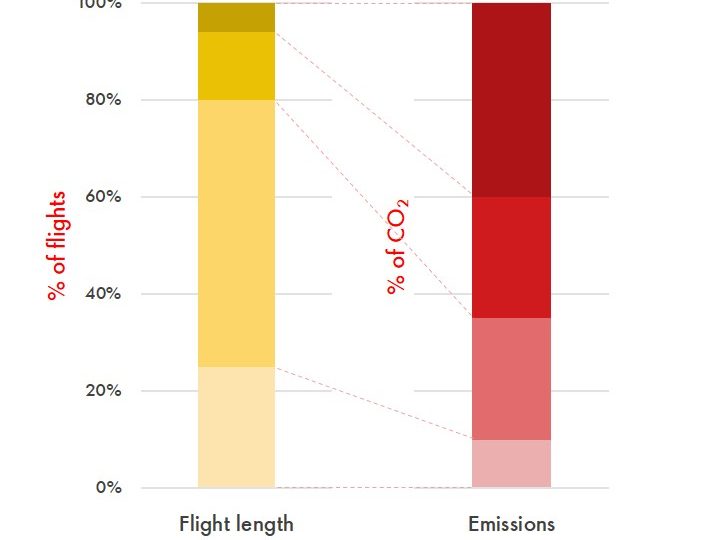

In terms of scale, Carbon Tracker are right – investment in liquid hydrocarbon combustion planes (using Jet-A1, SAF or e-SAF) dwarfs new propulsion aircraft investment even though the industry has set clear targets to be at net-zero emissions by 2050. So why would an industry that is intent on managing its carbon footprint act in this way? There are several reasons. The first is that SAF (and even e-SAF) is becoming a reality and supply is growing globally, although SAF currently accounts for less than 0.6% of total aviation fuel consumption, highlighting the urgent need for wider adoption. The second factor relates to the discussion above; maintaining a tried and tested technology solution for aviation is critical and any risk-averse behaviour is due entirely to safety considerations, which is a paramount concern for the industry. Finally, there is the reality of flights and CO2 profiles as shown in the chart below, where we see that a minority of flights – the long-haul flights – are responsible for a sizable share of total aviation CO2 emissions. Electric planes and first-generation hydrogen planes are going to be for shorter haul routes, which have limited overall CO2 impact. The long-haul flights today make up 20% of all flights but account for nearly 70% of emissions and these flights won’t be serviced by battery electric or hydrogen planes for a long time. As such, heavy investment in electric and hydrogen aviation won’t have much impact on the aviation CO2 profile by 2050 because long-haul versions of such aircraft could be several generations of development away.

Source: The high-resolution Global Aviation emissions Inventory based on ADS-B (GAIA) for 2019–2021, Teoh et al., Atmospheric Chemistry and Physics, 24, 725–744, 2024.

New aviation technologies will emerge, and the industry will eventually move on from the current technology solution, but don’t expect that for 2050, at least not as the main mechanism for managing CO2. Over the relatively short period of 25 years to 2050, for an industry that operates on timelines of 30-80 years, the solution will rest with the increased use of sustainable aviation fuel and the ability to manage CO2 through carbon removal credits (for more on this, see Like it or not, carbon management is the future – Shell Climate Change).

Note: Shell Scenarios are not predictions or expectations of what will happen, or what will probably happen. They are not expressions of Shell’s strategy, and they are not Shell’s business plan; they are one of the many inputs used by Shell to stretch thinking whilst making decisions. Read more in the Definitions and Cautionary note. Scenarios are informed by data, constructed using models and contain insights from leading experts in the relevant fields. Ultimately, for all readers, scenarios are intended as an aid to making better decisions. They stretch minds, broaden horizons and explore assumptions.

Leave a comment