I recently attended an emission trading conference in Paris and like many such events in the EU now, one of the first items on the agenda (and in this case it was the first) was a presentation and discussion on the US Inflation Reduction Act (IRA). The fact that the IRA isn’t an emissions trading system didn’t matter. The IRA has upended the climate discussion in the EU in that projects are happening in the US, and change is underway, while a key green technology sector like the EU wind industry is facing headwinds.

After years of attempting to implement carbon pricing but finding it to be politically impossible to do so, the USA has taken a very different track to the EU where the flagship policy is the EU Emissions Trading System (EU ETS) and its carbon price, currently around €80 per tonne CO2. The IRA offers tax credits across a range of technologies, from electric vehicles to direct air capture (DAC), with the benefits for the latter of up to $180 per tonne CO2 when geological storage is involved (DACCS). Earlier this year Goldman Sachs estimated that the IRA could deliver as much as $1.2 trillion of incentives by 2032 and spur $2.9 trillion of cumulative investment opportunity across sectors for the re-invention of U.S. energy system. Little wonder the IRA features at the top of a climate change conference agenda in the EU.

Meanwhile, presentations about the EU ETS at the same conference pointed to a system with growing ideological constraints. Top of the list is the near absence of a carbon removals framework such that this key set of technologies can start featuring in EU ETS driven investment decisions. Rather, it almost felt as if the EU is just expecting emissions to fall to zero by the early 2040s, thus avoiding any major need for removals. It isn’t clear how this might happen in practice and certainly none of the scenario work done in Shell points to anything even close to such an outcome. Even in our most ambitious scenario, Sky 2050, the global energy system will remain bound to fossil fuel use right through the middle of the century and beyond, albeit sharply decreasing, with the end of the fossil fuel era not even in sight until the 2080s. As such, carbon removal technologies like direct air capture with storage (DACCS) need momentum today, which is happening in the US under the IRA, but the equivalent investment in Europe is essentially zero.

The different approaches in the EU and USA are highlighted in our Energy Security Scenarios, released a few months ago, through the use of behavioural archetypes. The EU is a Green Dream region, meaning that they are ideologically attached to removing fossil fuels from the energy system as fast as possible. By contrast, the USA, along with other major resource countries, are characterised by the tagline Innovation Wins, which means that they will tackle the issues in the energy system through innovation, but with pragmatism prevailing. If that means using fossil fuels in some applications and developing DACCS to manage emissions, then so be it. No ideology, just money and science.

One of the strengths of the World Energy Model (WEM) that sits behind our scenarios is the ability to drill down into single countries, technologies in countries or sectors in countries. And I have done just that for the USA with the WEM to illustrate the pathways for our two new scenarios, Sky 2050 and Archipelagos. These are stories that are full of technology and innovation, with rapid change resulting.

Firstly, just a reminder of the two scenarios:

Archipelagos depicts a global narrative of shifting political winds driving the transition away from fossil fuels. Despite encountering challenges, the pace of the transition accelerates due to heightened security concerns and competition. This scenario envisions a world where energy security takes precedence over emission management.

Sky 2050 explores a world in which long-term climate security is the primary anchor. Society rapidly moves towards net-zero emissions but doing so requires major interventions from policymakers in the energy system.

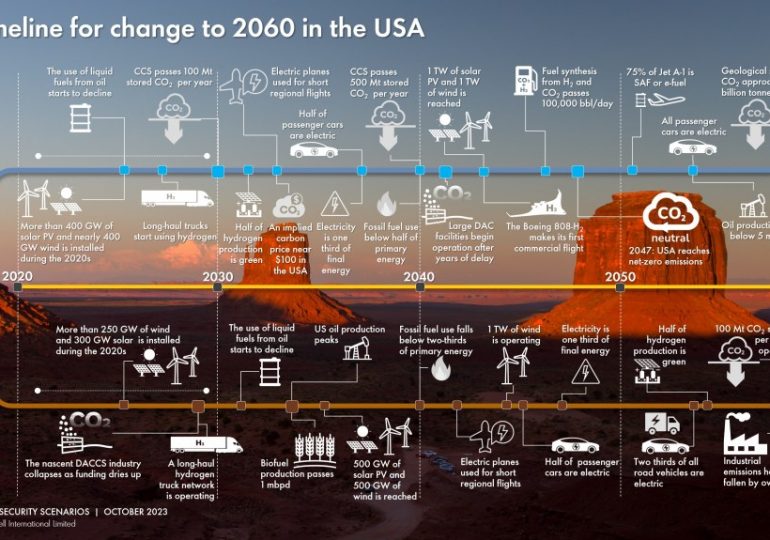

The scenario timeline for the USA through to 2060 is shown below, built by extracting multiple different views of the US energy system from the WEM database.

A defining feature is that even in the slower transition, Archipelagos, the USA is closing in on net-zero emissions by 2060, years before other countries. This is linked in part to the IRA today, which establishes momentum behind both transformative energy technologies and CCS, although in the case of the latter not on the scale seen in Sky 2050. One key difference between the scenarios is the complete disappearance of the DAC industry in Archipelagos, whereas it booms in Sky 2050 once high initial costs come down. The emergence of DAC in Sky 2050 also gives rise to a synthetic fuel industry in the USA, which tempers hydrogen use for aviation later in the century compared to Archipelagos.

In Sky 2050 net-zero emissions is reached in the late 2040s in the USA, before the current 2050 goal.

But both scenarios for the USA see an all-electric passenger car market, hydrogen road freight, electric airplanes, expanding biofuel production, hydrogen jet travel (not shown above for Archipelagos but from 2050), solar and wind expansion and of course falling emissions.

In the USA, at least, innovation does win!

Note: Shell Scenarios are not predictions or expectations of what will happen, or what will probably happen. They are not expressions of Shell’s strategy, and they are not Shell’s business plan; they are one of the many inputs used by Shell to stretch thinking whilst making decisions. Read more in the Definitions and Cautionary note. Scenarios are informed by data, constructed using models and contain insights from leading experts in the relevant fields. Ultimately, for all readers, scenarios are intended as an aid to making better decisions. They stretch minds, broaden horizons and explore assumptions.

Leave a comment