Bottles of beer emblazoned with the five Olympic rings are already rolling off the production line at Anheuser-Busch InBev NV’s brewery in Belgium, in preparation for the games in Paris this summer.

It has been 100 years since the French capital last hosted the summer Olympics, and the city wants to make a mark after Covid meant the Tokyo Games were held in virtually empty stadiums. And now, for the first time ever there will be a beer sponsor for an event that showcases the pinnacle of human sporting achievements.

[time-brightcove not-tgx=”true”]

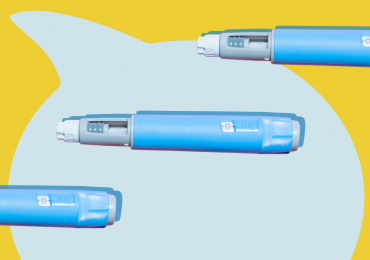

But in this case, the drink—Corona Cero—doesn’t have any alcohol.

The world’s biggest brewer has chosen to advertise to billions of sports fans a zero-alcohol product only launched in Europe two years ago. AB InBev hopes to use the Paris Games—expected to be one of the biggest marketing bonanzas the Olympics has ever seen—to improve its position in the only part of the global beer industry that’s really growing.

Read More: Why Beer Is the World’s Most Beloved Drink

Worth $13 billion and counting, brands from Heineken to Guinness, and now Corona Cero, see a cohort of health-conscious consumers—many young, others older and wanting out of a booze culture—whose wallets they can tap.

Master brewers have been working on formulas to try to replicate the taste and texture of the real thing. Heineken, Guinness and Budweiser are all now available alcohol-free, while hundreds of craft brewers and newer labels are emerging to target the market.

For Michel Doukeris, the chief executive officer of AB InBev, it’s quite simple: “The consumer has changed.”

No-alcohol beer, or beer with alcohol content under 0.5%, is a tiny corner of the market, its 31.4 million hectoliters a year dwarfed by the 1.93 billion hectoliters of alcoholic beer, according to GlobalData Plc. But it’s had an annual compound growth rate of 3.6% since 2018, versus 0.3% for alcoholic beer. In the U.S., adults age 18 to 34 who say they drink has dropped from 72% in the early 2000s to 62%, according to Gallup.

Those are numbers businesses can’t ignore, especially AB InBev. It’s already lagging behind and says it will miss a target of 20% of sales from low or no-alcohol beer by 2025.

“There are a lot of sports events like the Olympics where the flagship brands are often the 0% variant,” said Susie Goldspink, head of no and low alcohol insights at market researcher IWSR. “That’s partly because it’s such a growing area but it also helps with their moderation agenda of responsible drinking.”

There’s also a wider benefit for beer companies. Because their no-alcohol versions often share the same name and labelling as the original beer, the promotions help brand awareness and allow firms to circumvent increasingly tighter restrictions around alcohol advertising.

The Olympics is part of a trend of zero-alcohol beers being promoted via sport, including Heineken 0.0 with Formula 1 and Diageo Plc’s Guinness 0.0 at the Six Nations rugby tournament. Carlsberg A/S last year handed out 400,000 cans of French no-alcohol beer Tourtel Twist at the Tour de France cycling race.

Read more: How to Talk About Beer Like a Pro

And in a sign of the competition between brands, Carlsberg is positioning Tourtel Twist as the non-alcoholic beer of choice at the Paris Games.

“We are the official beer of Paris and France,” said Jacob Aarup-Andersen, CEO of Carlsberg. “They are the official beer of the Olympic movement. At the events you are going to be served Tourtel.”

U.S.-based Athletic Brewing Co., which sells only non-alcoholic drinks, says an Olympic sponsorship benefits the entire category.

“Sometimes to move the needle you need bigger players that can help drive awareness,” said John Walker, the company’s co-founder.

For drinks companies, there’s a pressing need to keep up with shifting trends that have already proved the death knell for many businesses. More than 7,000 bars in the U.K. closed in the last decade, according to the British Beer and Pub Association. While alcohol duties, rents, costs and regulations all played a part, so too have changing drinking habits.

As consumers, particularly social media-driven millennial and Gen Z demographic groups, look to temper their alcohol intake, it’s better to have a viable—and attractive—offering rather than have them turn to a rival brand, a soda or water.

Heineken 0.0 is the market leader in the no-alcohol beer market globally, according to GlobalData. Other big sellers are Japan’s Suntory All-Free, and Brahma 0.0%, owned by AB InBev.

At the world’s oldest continuously operating brewery in Germany, non-alcoholic beers have been in production since the early 1990s. But in 2020, thanks to rising demand, Bavaria-owned Weihenstephan more than doubled its alcohol-free beer capacity, taking a bet on future growth. Today, its non-alcoholic wheat beer is almost 10% of sales, and its third best-selling product.

But all the promotion in the world can only take zero-alcohol beer so far if it isn’t any good.

Until relatively recently, non-alcoholic beer compared poorly to the original, leaving drinkers unsatisfied. For brewers, there was a technical conundrum: how to achieve the depth of taste without alcohol. Do they stop beer from forming alcohol during the fermentation process or do they remove it after brewing a full-strength version?

According to Jim Koch, chairman of Boston Beer Company, which makes Samuel Adams, taste breakthroughs have only been possible in recent years as brewers figured out a low temperature distillation process. The brewer introduced its own non-alcohol product, Just The Haze, in 2021.

Launched in 2017, Heineken 0.0 is made with water, barley malt, hop extracts and yeast—the same ingredients used for Heineken. The alcohol is then removed using vacuum distillation, after which natural flavorings and aromas are blended back in to make the taste more closely resemble the original.

“For a couple of years, I refused to start developing Heineken 0.0,” said Willem van Waesberghe, Heineken’s global master brewer. “Because I’d never tasted a good one.”

The Olympic Games kick off in two months, with the Opening Ceremony taking place on July 26. AB InBev will soon unveil details of its campaign, which it expects will “accelerate no-alcohol beer growth.”

Beyond that, getting no-alcohol beer on tap is expected to deliver the next leap in terms of volumes, increasing sales in bars by making the drinks more socially acceptable. It’s yet another technical challenge, but one that brewers are working on.

“It’s like rosé in the south of France is always better than at home,” said Waesberghe. “And in a bar you like the draft, it gives you the impression of authenticity.”

Leave a comment