This post is a guest contribution by Thomas Akkerhuis, Energy Analyst and Richard Baker, Senior Energy Adviser, both in the Shell Scenarios Team.

As the Brazil hosted G20 approaches and thoughts regarding COP30 in 2025, also in Brazil, start to appear, Brazil’s own climate efforts and energy system are becoming headline news. In a recent article, the Financial Times describes the challenge the country faces in balancing two fundamental ambitions: to be a global environmental leader while also growing its position as global player in oil production.

There is natural skepticism over whether balancing these seemingly contradictory positions is at all possible, with the Climate Observatory stating that “you can’t be a leader on the environment and climate and at the same time become a mega-producer of oil.” Perhaps Brazil is following a very narrow path here, but there are good reasons for doing so.

In June this year the Shell Scenarios Team published a Brazil Scenarios Sketch, which there are now several blog postings about, for example, this one. The Sketch is derived from Shell’s latest Energy Security Scenarios. The Scenarios Sketch shows, among other things, that both ambitions are realistic ambitions for Brazil:

Brazil has enormous potential to manage the world’s carbon emissions through land-use change, and it can help decarbonise the world through the production of biofuels. Emerging global demand for this capacity, because of climate change pressures, are important reasons to make use of those opportunities.

Brazil has significant fossil fuel reserves, with the potential to develop significantly more. There is an important economic argument for developing them. Today, Brazil has a gross domestic product that is below the global average (per capita basis), which is also more unevenly distributed than the global average (Gini coefficient basis). Many other countries have also built their wealth on the production and consumption of fossil fuels.

The sketch is an in-depth study of potential futures for Brazil’s energy and carbon system, through the lens of two scenarios: Sky 2050, and Archipelagos. Both start with the realities of the 2020s, including the struggle to end deforestation in Brazil. As time moves on into the 2030s Sky 2050 takes a normative approach that starts with the desired outcome of global net-zero emissions in 2050 and works backwards in time to explore how that outcome could be achieved. By focusing on security through mutual interest, the world achieves the goal and a global temperature rise of less than 1.5°C by 2100. Archipelagos follows a possible path in a world focusing on security through self-interest. Even so, change is still rapid, and the world is nearing net-zero emissions by the end of the century but the temperature outcome in 2100 is a plateau at 2.2°C.

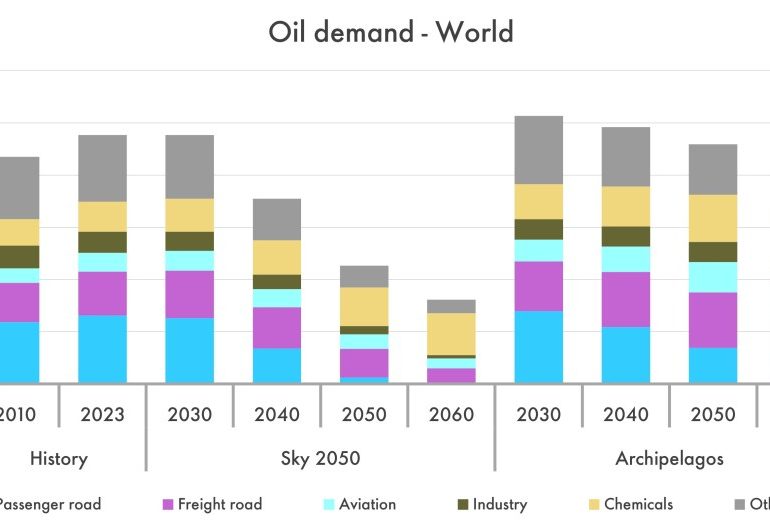

The starting point for a deeper look at Brazil’s oil production prospects is the anticipated global demand in each scenario. The figure below shows that evolution through to 2060. Demand in 2030 remains at least at 2023 levels in both scenarios, and two decades later in 2050 when Sky 2050 is at net-zero CO2 emissions, the scenario range is still 40-85% of 2023 levels. While a fuel like coal may dwindle quite quickly in a world targeting net-zero emissions, significant oil demand will be with us well unto the second half of the century.

Global oil demand broken down by scenario and use

Oil has an abundance of uses, and for many of them, a lower-carbon alternative is not yet available (at scale). While the world has seen significant progress in electrification of cars and light-duty trucks, and this trend accelerates in both scenarios, the decarbonization of heavy long-haul road freight is a decade or more behind cars: in 2050, oil demand in the road freight sector has not even halved in Sky 2050 and in Archipelagos has even grown.

Other heavy-duty transport has even more difficulties moving away from oil: for example, airplanes, ships and agricultural equipment. Electrification is often not possible, and alternatives like biofuels and hydrogen are in their infancy. In Archipelagos, oil demand for these purposes grows over the next 3-4 decades. And finally, oil is essential to the chemicals industry – which is an industry that is set to grow as more and more people in developing countries move into middle income lifestyles.

Given that the world will need solid and reliable sources of crude oil for decades to come, how might Brazil fit into this picture? The charts below show Brazil’s oil production in the two scenarios, compared with domestic demand and natural field decline given no further investment. Remember that Brazil already makes significant use of ethanol for passenger road transport and increasing use of biodiesel for trucks.

Domestic demand and production of oil in Brazil in Sky 2050 and Archipelagos scenarios. Natural decline assumed 4.5% per year.

Both scenarios have short term production growth already locked in, driven by the development of the Buzios and Mero fields with investment decisions already made. The difference is what happens towards 2040 and thereafter.

In Sky 2050, natural decline matches falling domestic demand from 2040 onwards, but still allows Brazil to maintain a 3% global market share of oil production. In this scenario, Brazil becomes adept at managing carbon emissions and reaches net-zero emissions around 2040 and ahead of almost every other country in the world. Maintaining its role as an oil producer and growing exports in the near term does not undermine it’s net-zero goals.

In Archipelagos, oil production is a growing contributor to the country’s economy, exceeding domestic demand, and growing market share to almost 7% of global production. In this case, Brazilian oil is sufficiently competitive to squeeze out market share from other countries. However, this does not just happen: the best fields have already been commercialized, and while extensive underexplored coastline has huge potential, it does not come with guarantees. Additionally, even if not for export, ongoing investment and exploration would be needed just to maintain current levels of energy security.

In both scenarios, Brazil is an important oil producer – at least in the next decade, offering an opportunity to support its growing economy. And after that, Brazil will keep producing oil – at least to satisfy its domestic demand, and possibly to grow its global market share. Additionally, in Archipelagos, Brazil becomes a key regional supplier offering improved energy security for the Atlantic Basin countries, security being an overriding feature of the scenario. Both the Energy Security Scenarios and the Brazil Scenarios Sketch show a similar view for oil production growth for the next decade, before more substantial divergence starts.

Not all the country’s pathways in the sketch are so divergent, as can be seen below. In both scenarios, biofuel production will double mid-century, and in both scenarios, the trend of ongoing deforestation will be broken. In both scenarios, for biofuels, a large market is emerging as sectors and countries seek to replace their oil-based fuels with biofuels – such as in aviation. Article 6 of the Paris Agreement provides the possibility for sectors and countries to invest in land-use related projects in Brazil to offset their own hard-to-abate emissions.

Biofuel production and land-use change in Brazil in Sky 2050 and Archipelagos

It is a narrow path for Brazil, but the country can make the most of its oil resources while also developing its biofuel and carbon management potential. Both have wider benefit given the continued global demand for oil and focus on security of supply, but also the growing global demand for lower carbon fuels and carbon removal mechanisms. The only real difference between the scenarios is the mix and timing.

Sky 2050ArchipelagosOilNow to early/mid-2030s: growth Mid-2030s to 2050: energy securityNow to 2050: growth 2030 to 2050: major exporterLand-use changeFast turnaround in emissions, an end to deforestation in 2033Turnaround in emissions, net-zero deforestation in 2049BiofuelsDoubled by 2050Doubled by 2050

Note: Shell Scenarios are not predictions or expectations of what will happen, or what will probably happen. They are not expressions of Shell’s strategy, and they are not Shell’s business plan; they are one of the many inputs used by Shell to stretch thinking whilst making decisions. Read more in the Definitions and Cautionary note. Scenarios are informed by data, constructed using models and contain insights from leading experts in the relevant fields. Ultimately, for all readers, scenarios are intended as an aid to making better decisions. They stretch minds, broaden horizons and explore assumptions.

Leave a comment