A property-tax alternative chosen by an Ohio county will likely give it more total financial benefits from a proposed solar project than the property tax option would, according to an independent academic analysis.

The Ohio State University analysis undercuts recent claims by critics who have alleged the payments in lieu of taxes, or PILOT, plan for the 120 megawatt Frasier Solar project is a bad deal for Knox County.

Instead, the arrangement would boost the county’s revenue under all but one scenario evaluated by economics professor Brent Sohngen, who has been researching the economics of solar development and looked at the numbers after hearing about the debate.

The study is in contrast to an analysis in November by the conservative Buckeye Institute, which said the plan would “shortchange taxpayers.”

But Sohngen, who has not taken a position on the project itself, said the Buckeye Institute declined to provide the data underlying its assumptions.

“As an academic, it’s my job to help explain the numbers, which is all I’m trying to do here,” Sohngen said. “The local community has a tough decision, but it’s made tougher when they are faced with confusing data and analysis where some of the proponents won’t even provide the basic data they are using.”

Benefits to both sides

Ohio’s program for payments in lieu of taxes allows developers or owners to remit payments to local governments which are generally level over the useful life of an energy project. Property tax amounts, in contrast, start out high but decrease over time due to depreciation.

Ohio lawmakers passed legislation last year extending counties’ ability to choose the arrangements. Solar and other energy projects can qualify if they meet certain criteria. Among other things, 70% of a solar project’s workers must be Ohio residents. Developers or owners of projects larger than 20 MW must also repair roads, bridges or culverts affected by construction.

The arrangements can provide financial benefits for both solar project developers and for counties.

A project developer or owner can avoid very high payments in the first few years of operation, reducing costs and the prices they can charge for electricity. In return, counties get predictable payments, which can help in budgeting.

Importantly, the payments also don’t reduce local governments’ needs-based education funding like property taxes would, Sohngen said. Solar developer Open Road Renewables estimated those cuts would come to about $8.5 million over the life of the Frasier Solar project.

Crunching numbers

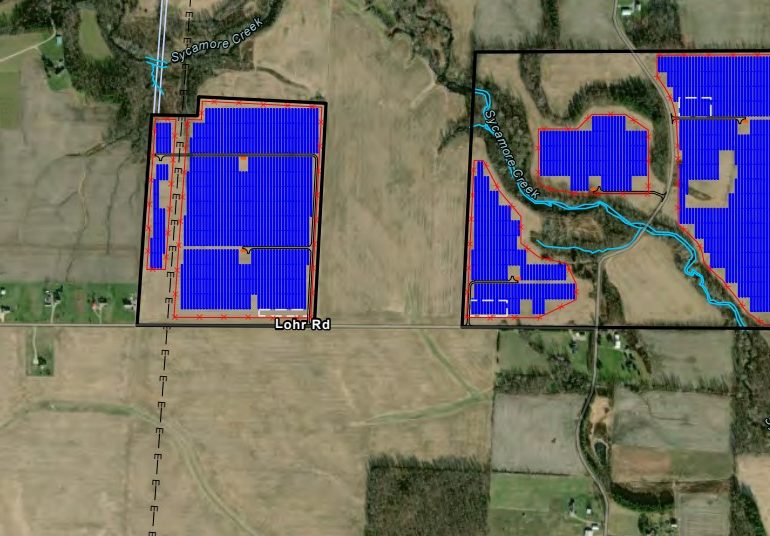

Knox County’s commissioners unanimously approved the alternative payments for the Frasier Solar project last August. An analysis filed with the Ohio Power Siting Board last October shows the county will get approximately $1,080,000 annually for roughly 40 years. That time period is the project’s estimated life span.

Other materials filed by the company with the siting board show the payments would give the county $4.6 million more than property taxes would over the life of the project, with revenue exceeding estimated property taxes by year 16.

The Buckeye Institute faulted Open Road Renewables for not including a net-present value cash-flow analysis with its siting board filings. That would deal with the concept that $1 today is worth more than $1 in the future. The Buckeye review also suggested the payments wouldn’t break even with property taxes until the end of the project.

The Buckeye Institute generally sees the alternative payments as “a form of subsidy through near-term tax breaks to renewables,” said Trevor Lewis, who co-authored the Buckeye report with Rea Hederman. Comments filed by the group with the federal Office of Management and Budget had also urged it to use a higher discount rate for the value of money collected in the future, he said.

The Buckeye Institute analysis was cited at a Nov. 30 meeting held by Knox Smart Development. Jared Yost, who incorporated that opposition group in November, has said it’s a grassroots group but it does not want to disclose who its funders are. Speakers at the November meeting had multiple ties to fossil fuel interests, the Energy News Network found.

Counties generally don’t consider net present value for budgeting purposes, said Cyrus Tashakkori, president of Open Road Renewables. The company also pointed out to the Buckeye Institute that its analysis left out cuts in needs-based school funding if the county had picked property taxes instead. The school funding issue makes the payments worth more to the county, even when net present value was considered, he said.

“They got it wrong. And then instead of just correcting it, they very publicly doubled down,” said Tashakkori.

The Buckeye Institute’s December update noted the criticism, questioned the certainty of future school funding, and repeated its stance that alternative payments were not a “clear winner.” A Feb. 12 response to Sohngen’s analysis pushed for using a higher discount rate for the time value of money and anticipated inflation, even while acknowledging that it was above the rate in revised federal guidance last year.

“They won’t send anyone their underlying data, nor will they explain how they got it, so there is not much else one can do with their work other than wonder why they won’t provide it,” said Sohngen, who contacted the Buckeye Institute before publishing his work.

Only in one scenario did Sohngen find property taxes would be “modestly” better for the county. However, that scenario wasn’t consistent with current federal guidance, and it assumed interest rates that haven’t been seen for decades, Sohngen said.

“It was refreshing to see honest analysis by an expert confirmed what we had known based on our analyses,” said Craig Adair, vice president for development at Open Road Renewables.

Sohngen said no one from Open Road Renewables asked him to do his analysis, and Adair confirmed that.

Opportunity costs

Confusion about how solar projects will help local governments can increase negative perceptions, wrote Doug Bessette and others in this month’s issue of Energy Research and Social Science. Bessette heads the Energy Values Lab at Michigan State University’s Department of Community Sustainability. Better communication can help reduce confusion, the researchers suggested.

“The fact that Brent Sohngen’s calculations are all provided for readers and can be easily replicated if they choose to do so is the best we can ask for,” Bessette said. Different parties’ values and concerns can affect how people choose discount rates, but some quantitative analysis can help keep discussions focused on facts, he added.

Opportunity costs also matter. Ohio law taxes agricultural land at substantially lower rates than for residential or commercial property. The land for the Frasier Solar project currently generates only about $21,000 per year in property taxes.

“So whether you go the tax revenue approach or the PILOT approach, it’s far more money” for the county, Sohngen said. Open Road Renewables estimates the payments in lieu of taxes would bring the county more than 40 times as much revenue as it currently gets for the project’s proposed land area.

“Not deciding to go forward on a solar project is a choice. And that choice has consequences,” Bessette said. When neighboring counties adopt solar and increase revenue, they can use it to build better schools, hire more teachers or improve other local services. And communities that choose not to increase their revenue will ultimately lose out, he said. “You don’t want a race to the bottom.”

With that said, addressing the positive and negative impacts of large-scale solar projects still presents challenges.

“Ensuring developers and local officials thoughtfully consider the costs and benefits of a proposed project is a good thing, not a bad thing,” Bessette said. “And making sure residents have an avenue to voice their concerns is crucial, as long as those concerns aren’t fictions. It’s just that it’s getting harder and harder to distinguish fiction from reality.”

Ohio county sees dueling studies on solar project payments, but only one disclosed its data is an article from Energy News Network, a nonprofit news service covering the clean energy transition. If you would like to support us please make a donation.

Leave a comment