Just a year ago the scenarios team in Shell published The Energy Security Scenarios, a look at the world through the dual lenses of climate change and rising security concerns. Today, the two scenarios seem more prescient than ever as ongoing events continue to reinforce these two very separate directions of travel.

The two scenarios are Sky 2050 and Archipelagos. Both start with the realities of the 2020s, meaning that the energy system and future energy policy landscape are showing real signs of change, but also recognising that there is little in place on the scale required to reduce emissions substantially by 2030. As time moves on into the 2030s Sky 2050 takes a normative approach that starts with the desired outcome of global net-zero emissions in 2050 and works backwards in time to explore how that outcome could be achieved. By focusing on security through mutual interest, the world achieves the goal and a global temperature rise of less than 1.5°C by 2100. Archipelagos follows a possible path in a world focusing on security through self-interest. Even so, change is still rapid, and the world is nearing net-zero emissions by the end of the century but the temperature outcome in 2100 is a plateau at 2.2°C.

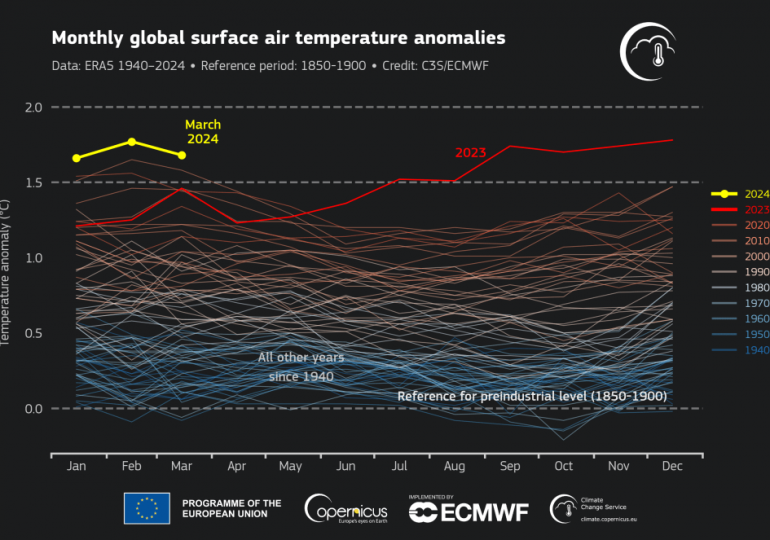

In recent days multiple events have reminded us of the stark realities we are collectively facing. This starts with the temperature. Copernicus, the EU climate change service, announced that March 2024 was warmer globally than any previous March in the data record, with an average surface air temperature of 14.14°C, 0.73°C above the 1991-2020 average for March and 0.10°C above the previous high set in March 2016. The month was 1.68°C warmer than an estimate of the March average for 1850-1900, the designated pre-industrial reference period, and the global-average temperature for the past twelve months (April 2023 – March 2024) is the highest on record, at 0.70°C above the 1991-2020 average and 1.58°C above the 1850-1900 pre-industrial average. The world is currently tracking above 1.5° and has been for several months. One data service, Berkeley Earth, also reported that 2023 was the first 1.5°C calendar year and others have subsequently reported a non-calendar year twelve month period being above 1.5°C.

Following on from the temperature announcement, the Executive Secretary of the UNFCCC, Simon Stiell, speaking at various events and then repeated on X (previously Twitter), said we have “two years to save the world“. He was referring to the two important COPs in 2024 and 2025 where nations will attempt to significantly step-up climate finance (COP29) and then submit new Nationally Determined Contributions (COP30), both in response to the recent global stocktake (COP28) and with the COP29 financial promises in hand.

The global security situation doesn’t require a reminder from me, but it has arguably deteriorated over the past twelve months. The recent exchanges between Iran and Israel are a reminder of the essence of the Archipelagos scenario, where mutual interest prevails and shorter-term geopolitical security challenges continually disrupt the focus and collective effort required to deliver net-zero emissions in 25 years.

Both Sky 2050 and Archipelagos see coal use declining rapidly by 2040 (much sooner for Sky 2050), but in Archipelagos shorter term concerns and the recent disruption in the global gas market see coal demand rising.

Unfortunately, the Archipelagos trend may also be playing out in reality. Coal capacity is continuing to rise despite the pledges and promises made at Glasgow and the statement in the Glasgow Climate Pact which called for ‘accelerating efforts towards the phase-down of unabated coal power’. A new report from Global Energy Monitor and others highlights the recent growth trend for new facilities. The report notes that 2023 saw the highest net increase since 2016 in operating coal capacity. The increase is primarily driven by a surge in new coal plants coming online in China (47.4 GW), and lower retirements in the United States (9.7 GW) and Europe (5 GW) compared to recent years.

But the eventual trend, even in Archipelagos, is that solar PV and wind are installed at such a rate that coal is outpaced and rapidly forced out of the mix. The turning point in both scenarios for a global decline in fossil power generation is this decade.

There are positive changes as well, although one comes as a bit of a shock. It is clear that there is a genuine global uptick in interest in the family of carbon capture and storage technologies. This includes the considerable funding incentive under the US Inflation Reduction Act (up to $180 per tonne of CO2 for direct air capture with storage), venture capital funding flowing into direct air capture (DAC), projects in China and the Middle East, renewed interest in Japan and the final investment decision on key hub projects, like Porthos in Rotterdam. But the surprise (and shock) came with the release of the EU Commission plan for a 90% reduction in emissions by 2040, which included references to perhaps 150-200 million tonnes per annum of CO2 storage (but even more CO2 captured due to the need to supply carbon for e-fuel production). This is required in just 15 years, which makes it more than a challenging target, perhaps formidable is the word. It is coming from an organisation that has tried hard to raise interest in CCS over many years, but after initial efforts in 2008 fell foul of the financial crisis, nothing much has happened. Suddenly, the EU needs 200+ projects by ‘tomorrow’!

Another feature of The Energy Security Scenarios that is worth a second look is the development of national archetype responses to the energy security challenges that countries are confronted with. Different nations respond to energy security concerns in different ways. To be able to reflect these differences in behaviour, we produced a set of four archetypes, which reflect the ability of countries to secure their own supply of energy and to cope with energy price volatility.

Innovation Wins can be seen in countries like the USA and major resource-holders such as those in the Middle East. These countries are often self-sufficient in energy so are not vulnerable to supply failures, but they are susceptible to swings in energy prices. They invest heavily in innovation and infrastructure as longer-term solutions to their energy needs and the needs of their energy customers.

Green Dream can be observed in the European Union. The EU’s wealth makes it relatively able to deal with energy price volatility, but its advanced economies and depleted energy reserves make it highly vulnerable to energy supply failures. These countries seek security by driving hard to reduce energy use, increasing energy efficiency and massively boosting renewable generation.

Great Wall of Change is mainly relevant to China. The size of China’s economy, its large coal reserves and the scale of the investments it is making in its own energy supply and infrastructure insulate it from both supply and price concerns. It looks to use its manufacturing strength to build its position as a global low-carbon energy powerhouse.

Surfers are countries that tend to be vulnerable to both energy supply disruption and price swings. They seek partnerships with others and try to ride the opportunities created by the actions of other archetype countries. These can be dynamic, fast-moving economies with much to offer, but still need strong ties with others to shape their actions.

One year on and The Energy Security Scenarios appear to be as relevant as ever. Please do take a second look, or for new readers, a welcome first look. You can find it here. And do explore the timeline!

Note: Shell Scenarios are not predictions or expectations of what will happen, or what will probably happen. They are not expressions of Shell’s strategy, and they are not Shell’s business plan; they are one of the many inputs used by Shell to stretch thinking whilst making decisions. Read more in the Definitions and Cautionary note. Scenarios are informed by data, constructed using models and contain insights from leading experts in the relevant fields. Ultimately, for all readers, scenarios are intended as an aid to making better decisions. They stretch minds, broaden horizons and explore assumptions.

Leave a comment