A top executive with Minnesota’s largest utility says data center growth will not prevent it from meeting the state’s 100% clean electricity law, but it may extend the life of natural gas power plants into the next decade.

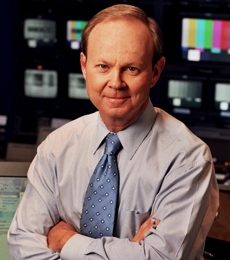

“As we take all of that coal off the system — even if you didn’t add data centers into the mix — I think we may have been looking to extend some gas (contracts) on our system to get us through a portion of the 2030s,” said Ryan Long, president of Xcel Energy’s division serving Minnesota and the Dakotas. “Adding data centers could increase the likelihood of that, to be perfectly honest.”

Long made the comments at a Minnesota Public Utilities Commission conference last month exploring the potential impact of data centers on the state’s 2040 clean electricity mandate.

The expansion of power-hungry data centers, driven by artificial intelligence, has caused anxiety across the country among utility planners and regulators. The trend is moving the goalposts for states’ clean electricity targets and raising questions about whether clean energy capacity can keep up with demand as society also tries to electrify transportation and building heat.

Minnesota PUC commissioner Joe Sullivan organized last month’s conference in response to multiple new data centers projects, including a $700 million facility by Facebook’s parent company Meta that’s under construction in suburban Rosemount. Microsoft and Amazon have each acquired property near a retiring Xcel coal plant in central Minnesota.

“We need to ensure that our system is able to serve these companies if they come,” Sullivan said, “and that it can serve them with clean resources consistent with state law.”

Alongside concerns about whether clean energy can keep up with new electricity demand, there’s also an emerging view that data centers — if properly regulated — could become grid assets that help accelerate the transition to carbon-free power. Several stakeholders at the Oct. 31 event shared that view, including Xcel’s regional president.

A 100-megawatt data center could generate as much as $64 million in annual revenue for Xcel, enough to help temper rate increases or cover the cost of other projects on the system, Long said. He said the company wants to attract 1.3 gigawatts worth of data centers to its territory by 2032, and it thinks it can absorb all of that demand without harming progress toward its 2040 clean energy requirement.

Long said data center expansion will not change the company’s plans to close all of its remaining coal-fired power plants by 2040, but it may cause them to try to keep gas plans operating longer. Ultimately, meeting the needs of data centers will require more renewable generation, battery storage, and grid-enhancing technology, but rising costs and supply chain issues have slowed deployment of those solutions.

Other utilities echoed that optimism. Julie Pierce, Minnesota Power’s vice president for strategy and planning said the company has experience serving large customers such as mines in northeastern Minnesota and would be ready to serve data centers. Great River Energy’s resource planning director Zachary Ruzycki said the generation and transmission cooperative “has a lot of arrows in its quiver” to accommodate data centers.

Ruzycki noted, too, that much of the interest it has received from data center developers is because of the state’s commitment to clean energy. Many large data center operators have made corporate commitments to power them on 100% carbon-free electricity, whether from renewables or nuclear power.

Pete Wyckoff, deputy commissioner for energy at the Minnesota Department of Commerce, expressed doubts about the ability to meet unchecked demand from data centers. Even with the state’s recent permitting reforms, utilities are unlikely to be able to deliver “power of any sort — much less clean power — in the size and timeframes that data centers are likely to request.”

He sees hydrogen, long-duration batteries, carbon capture, and advanced nuclear among the solutions that will eventually be needed, but in the short-term the grid could serve more data centers with investments in transmission upgrades, virtual power plants, and other demand response programs.

“These solutions can be deployed faster and cheaper than building all new transmission and large clean energy facilities, though we’ll need those, too,” Wyckoff said.

Aaron Tinjum, director of energy policy and regulatory affairs for the Data Center Coalition, said data centers provide the computing power for things like smart meters, demand response, and other grid technologies. The national trade group represents the country’s largest technology and data center companies.

“We can’t simply view data centers as a significant consumer of energy if they’re all helping us become more efficient, and helping us save on our utility bills,” Tinjum said.

He also pointed to data centers’ role in driving clean energy development. A recent report from S&P Global Commodity Insights found that data centers account for half of all U.S. corporate clean energy procurement.

The true impact of data centers on emissions and the grid is complicated, though. Meta, which participated in the recent Minnesota conference, says it matches all of its annual electricity use with renewable energy, but environmental groups say there is evidence that its data centers are increasing fossil fuel use and emissions in the local markets where they are built.

Amelia Vohs, climate program director with the Minnesota Center for Environmental Advocacy, raised concerns at the conference about whether data center growth will make it harder to electrify transportation and heating. She pointed to neighboring Wisconsin, where utilities are proposing to build new gas plants to power data centers.

“This commission and the stakeholders here today have all done a ton of work and made great progress in decarbonizing the electric sector in our state,” Vohs said. “I worry about possibly rolling that back if we all of a sudden have a large load that needs to be served with fossil fuels, or [require] a fossil fuel backup.”

The Minnesota Attorney General’s Office argued that state regulators need to scrutinize data center deals to make sure developers are paying the total cost of their impact on the system, including additional regulatory, operational and maintenance work that might be required on the grid.

In an interview, Sullivan said he was impressed by tech companies’ interest in having data centers in Minnesota because of the 2040 net zero goal, not despite it. They want to buy electricity from Minnesota utilities rather than build their own power systems or locate in neighboring states, he added, and the October meeting left him confident that “we can deal with this.”

Xcel Energy says data center growth won’t get in the way of 2040 clean energy target in Minnesota is an article from Energy News Network, a nonprofit news service covering the clean energy transition. If you would like to support us please make a donation.

Leave a comment